- Why Securonix?

- Products

-

- Overview

- 'Bring Your Own' Deployment Models

-

- Products

-

- Solutions

-

- Monitoring the Cloud

- Cloud Security Monitoring

- Gain visibility to detect and respond to cloud threats.

- Amazon Web Services

- Achieve faster response to threats across AWS.

- Google Cloud Platform

- Improve detection and response across GCP.

- Microsoft Azure

- Expand security monitoring across Azure services.

- Microsoft 365

- Benefit from detection and response on Office 365.

-

- Featured Use Case

- Insider Threat

- Monitor and mitigate malicious and negligent users.

- NDR

- Analyze network events to detect and respond to advanced threats.

- EMR Monitoring

- Increase patient data privacy and prevent data snooping.

- MITRE ATT&CK

- Align alerts and analytics to the MITRE ATT&CK framework.

-

- Industries

- Financial Services

- Healthcare

-

- Resources

- Partners

- Company

- Blog

Information Security, SIEM

By Sarah, Radin, Product Marketing Manager, Securonix

Although cybersecurity is essential for most industries, finance organizations, in particular, are one of the most regulated industries and face threats from both malicious actors inside and outside their organization. In fact, new data shows that the FTC received 2.8 million fraud reports in 2021. This number increased 70% over 2020 numbers. Financial data is a high-value target for cybercriminals, making data breaches a major concern for financial services and banking organizations. Securonix Next-Gen SIEM helps detect and respond to possible threats, reducing the risk to sensitive financial data by alerting analysts to concerning behavior before a breach happens.

Securonix Next-Gen SIEM baselines normal behavior patterns, detects suspicious data access, and identifies real threats to financial data, quickly and accurately. Our out-of-the-box threat content covers common use cases such as SWIFT monitoring, expense fraud detection, and more.

Use cases covered by Securonix

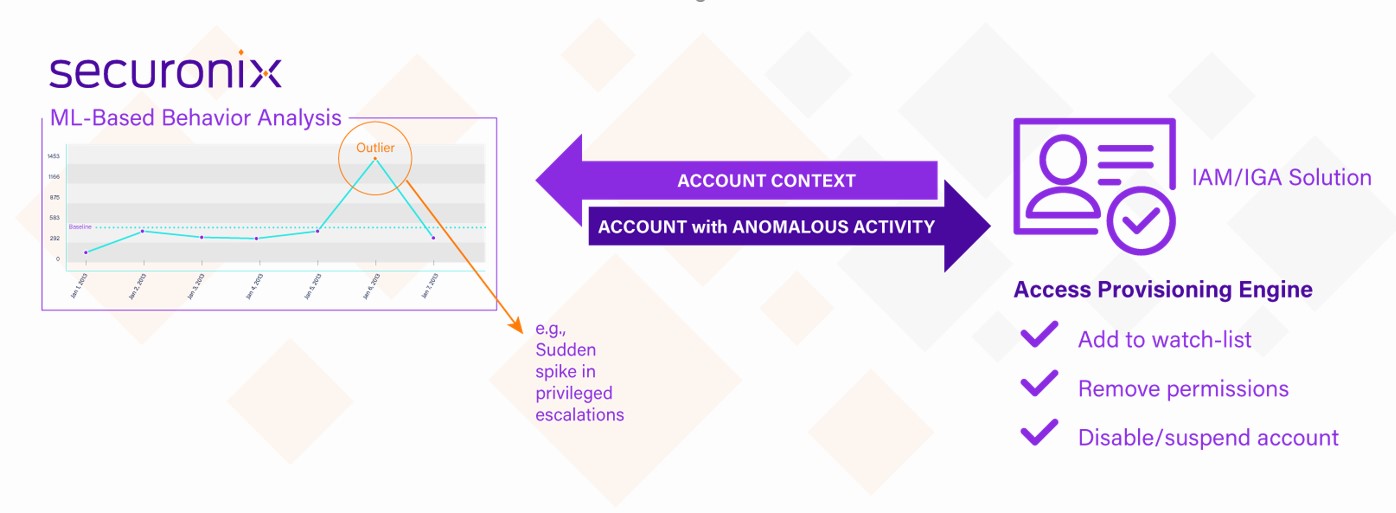

Monitor high-privilege accounts

Privileged account abuse poses one of the greatest threats to organizations, whether perpetrated by external attackers or insiders. Securonix identifies high privilege accounts, such as users with financial account transaction rights, and monitors them for abnormal behavior associated with an attack. Our solution can link high-risk behavior back to a real user and their risk profile in order to give a potential threat full context.

Meet regulatory compliance

Financial records contain sensitive payment data that need to be monitored for compliance and security. Our Next-Gen SIEM includes built-in masking, role-based access, and an audit trail that monitors financial data activities with minimal noise. Leverage out-of-the-box reports to help you stay compliant with major regulations such as GDPR, SOX, PCI DSS, and ISO27001.

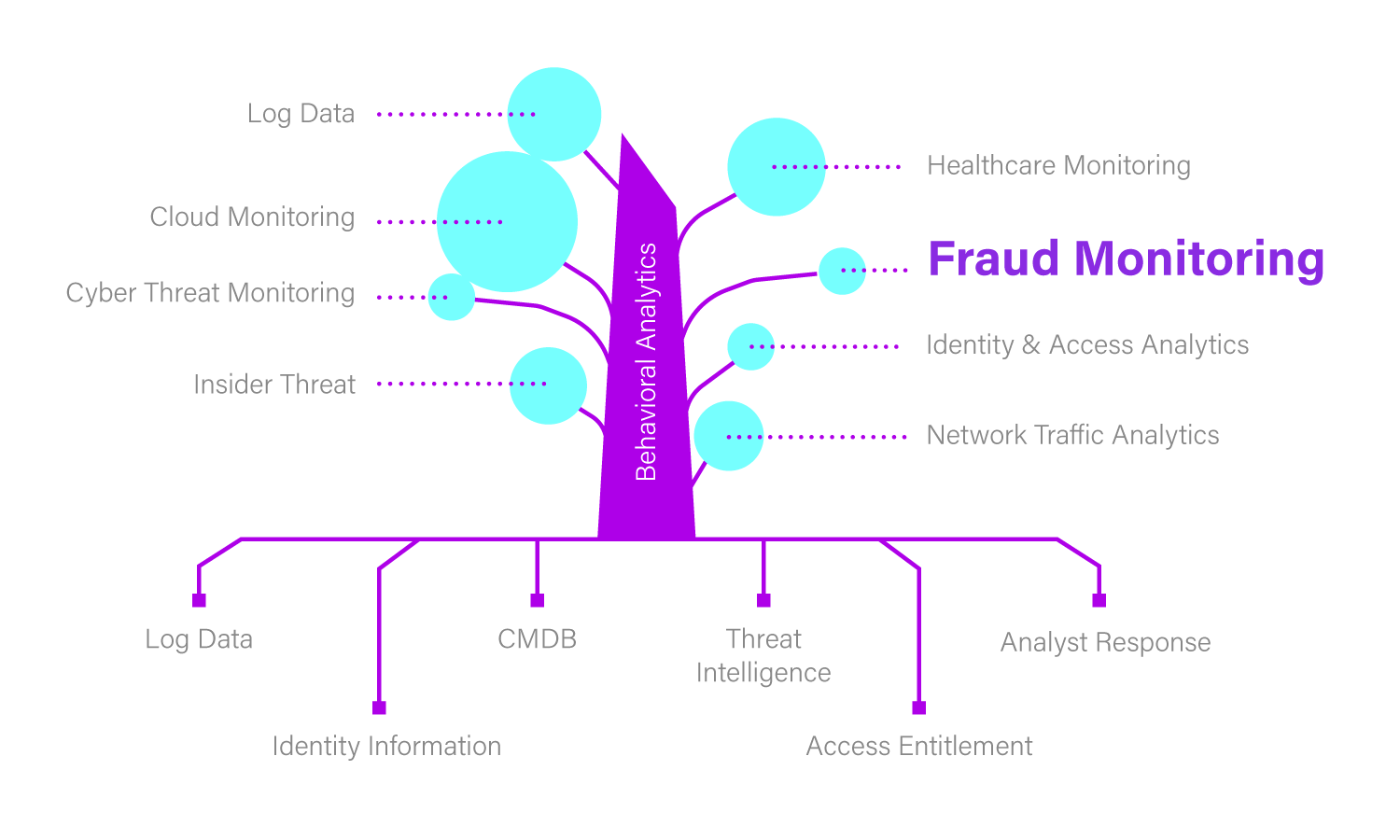

Identify fraud with built-in content

Securonix’s built-in content for fraud can stitch together a series of low-risk events and alert you before they become high-risk attacks. Fraud-specific threat chain analytics alerts you to anomalous activities and allows you to quickly mitigate the threat. Some key use cases include:

- Suspicious wire transfer detection (SWIFT monitoring)

- Expense fraud detection

- Accounts payable/receivable fraud

- Suspicious vendor transaction detection

- Detection of rogue orders/suspicious shipping requests

- Stolen card usage/CNP fraud detection

Gain visibility across your hybrid environment

Uncover blind spots in your multi-cloud environment and reduce complexity with a flexible, open architecture. With Securonix, you can ingest and view all of your data in a single UI. This allows you to discover anomalous activity on your network or suspicious transactions before they become a threat.

Securonix for finance

Monitoring financial data and records is essential, and Securonix can help. We enable security teams to increase application security and monitor users and entities by leveraging the latest advances in machine learning to alert you to compromise.